Improving your financial situation is not that easy to do, but if you have the determination for it, then everything is possible. Usually, at the beginning of the year, people tend to plan on how they will fix their finances. Some manage to do their plans successfully, but some people seem to have a hard time doing what they have intended to do.

So I’ve rounded up some of the most effective financial tips that you should start following if you want to save money effectively. They may seem hard to do at first, but if you have the determination to do it, then you will succeed.

1. Maintain A Good Record

Not maintaining a good record means you are not claiming your credits and the allowable deductions from your income tax. The best thing that you can do is to set up a place in your home where you can find everything that you need when it comes to credits and taxes. This will help you save money since you have all the records required to claim them.

2. Know How Much Your Job Is Worth

Some people tend to ignore how much their job is worth because all they think that matters is that they have a job, and it is giving them the income that they need. But the truth is, a lot of people are not getting the right salary for their respective jobs. The best thing that you need to do is to make sure that your contribution to the company, tasks, productivity, and your skills are all being paid with the right amount. If you are underpaid no matter how much it is, it can affect your entire working life.

3. Spend Below Your Means

No matter how high or how little you’re getting paid, you need to always live below your means. Remember that you will never get ahead with your finances if you consistently spend more than what you’re earning. Start cutting your expenses and eliminate the ones that you don’t actually need, like purchasing a cup of coffee instead of making one. You will notice how significant your savings will be in a month by making those small sacrifices.

4. Stick With Your Budget

Start making a budget and make sure to stick with it. This will help you achieve your financial goals. Also, budgeting will help you know where you’re putting your money in. Budgeting is essential, no matter how much you’re earning monthly. So always make it a habit to budget everything from your meals to your bills daily.

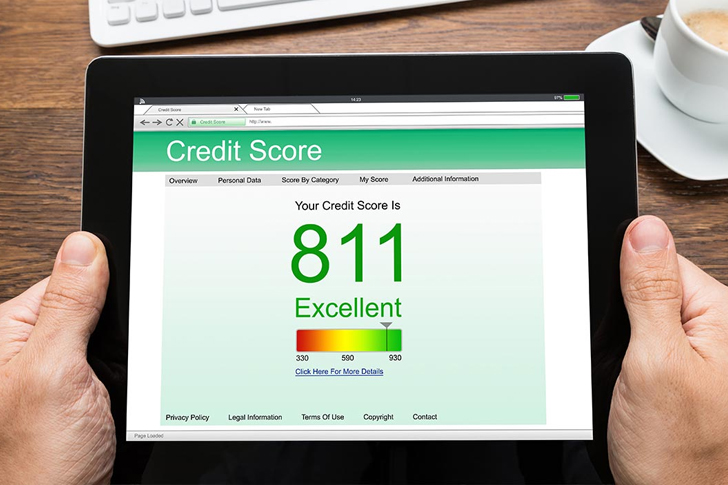

5. Pay Your Credit Card

One of the challenges why people are having a hard time getting financially ahead, is because of their credit card debts. That little plastic card may be useful, but it can also cause people to incur huge debts. Some people think that paying the minimum instead of the entire balance will help them save. But the truth is, they won’t be able to start saving until they paid every single credit card debt that they have. So before you start saving, start paying your debt off so you can save without any problem.

6. Start Contributing To Your Retirement Plan

If you are employed and your employer is paying off the entire company’s retirement plan, make sure to contribute to it. Typically, employers get a 401(k) plan, and if your employer has that, you need to sign up and start adding. The higher your contribution, the better the retirement plan will be. Now, if your employer doesn’t have any retirement plan for its employees, you should start getting an IRA.

7. Start Getting A Savings Plan

Once you get your monthly income, set a certain percentage aside, and save it. Avoid saving after paying your bills because you’ll end up not saving at all. The best thing to do is to have a savings plan and set a minimum of 10% of your income for your savings before you start paying bills. If possible, it would be best to have what you’re getting to your savings account automatically deducted from your paycheck.

8. Start Investing

Now, if you still have extra money after contributing to your retirement plan and setting aside an amount for your savings account, then it would be best to put some of that extra money into the investment. Some investments will help you earn extra income, so make sure to check out different investments that will match your needs.

9. Make The Most Out Of Your Employment Benefits

Employment benefits are known as flexible spending accounts, including dental and medical insurance. All of these are worth huge amounts, so make sure to make the most out of them. Always take advantage of the things that can help you save by reducing your own expenses and taxes.

10. Check Your Insurance Coverages

It would be best to check your insurance coverages regularly. Whether you have life insurance, disability insurance, or car loan coverages, you always need to make sure that you have enough insurance to ensure that you and the people who depend on you are protected. This will keep you and your loved ones prepared in case of disability or death.

11. Make Sure You Update Your Last Will

Based on a survey, there are 70% of Americans who still don’t have a last will. Typically, a last will and testament are done and given to a lawyer so that if anything happens to you, your family will be able to inherit your property fairly.

Conclusion

These are the 11 financial tips that you should start following and doing. These tips will help you kickstart your financial goal not only for your future but as well as for your family.

Photo Sources: Wostinson, Bankrate, Flickr, Military Wallet, Washington Post

Based on Materials from Her Money